The Leisure Technique Man breaks down Netflix’s 2020 with an emphasis on statistics of its exhibits and the way it carried out from a enterprise viewpoint.

If I had gone right into a coma and awakened on the finish of 2021, I’d not have believed my eyes once I learn Netflix’s 2020 annual report.

Not solely had Netflix continued its subscriber development from the earlier years (rising by 22% yr over yr in comparison with 20% development the yr earlier than), however Netflix was money movement constructive for the primary time since 2011. Much more, they did it with out both of their two greatest sequence, Stranger Issues and The Witcher!

I’d have been astounded.

There may be usually a tradeoff between growth and cash flow. And Netflix was rising and making tons of cash. In fact, upon waking up from this coma, you’d even have to inform me that there was a worldwide pandemic that locked people of their properties for months on finish, ended all theatrical distribution and stay performances, and despatched the world right into a recession.

Huh.

That’s the loopy factor about reflecting on 2020 for Netflix. This was arguably top-of-the-line years within the firm’s historical past, nevertheless it happens throughout a once-in-a-century (let’s hope!) pandemic.

So let’s evaluation the yr that was for Netflix. I’ll go quarter-by-quarter, highlighting the highest content material, enterprise information and normal occasions that impacted the streamer of file. Then, I’ll clarify the place the inventory worth went from there.

Q1 2020 – The World Goes Into Lockdown, and Netflix Has Their Most In style Content material

Prime Exhibits: Ozark, Tiger King

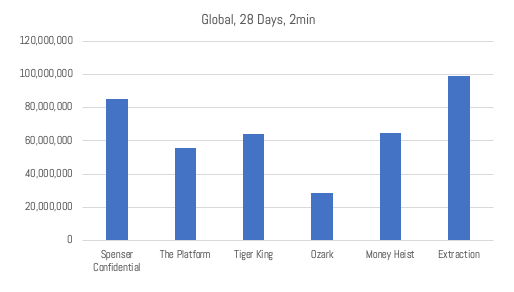

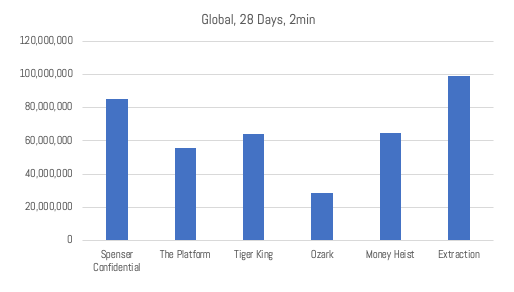

Prime Movies: Spenser Confidential, The Platform

Beginning in March, Netflix launched a string of exhibits that will find yourself turning into a few of their hottest of the yr, together with Tiger King and Ozark in the US across the globe. In December, I anointed Tiger King the most popular show of 2020 in America:

For information hounds resembling myself, Netflix additionally began releasing a buzzy new metric about their exhibits: each day high ten lists for movie, TV and all content material. With the caveat that we nonetheless do not know how Netflix measures this, it’s allowed some teams to trace what is the most popular content on Netflix over the year. Right here’s FlixPatrol’s tackle the most well-liked exhibits/movies in 2020:

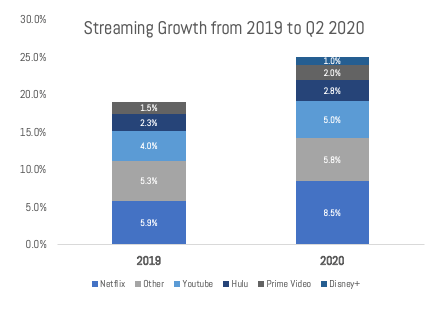

Whereas Netflix couldn’t have identified it was coming, they occurred to be releasing a few of their finest content material proper when the world would want it. March was when most nations all over the world entered Covid-19 lockdowns in the event that they weren’t in them already. As such, TV usage boomed and streaming shot up with it.

But, if people had been caught at house, that included the actors, administrators and workers wanted to make TV exhibits and flicks. This meant that Netflix, like most studios, needed to pause productions across the globe. Nevertheless, with theaters being closed, most studios wanted a brand new house for lots of movies that weren’t price holding for a yr or extra. Netflix was the beneficiary of this, shopping for the rights to much more movies it might debut all year long like The Lovebirds and The Trial of the Chicago 7.

Add all of it up and Netflix had certainly one of their finest quarters for world subscriber development, including 15.Eight million new subscribers (9.4% quarterly development) in a single month!

The outcome? After beginning the yr at $326, and cratering with the remainder of the inventory market, Netflix’s inventory worth jumped to $444 earlier than its earnings report. (It truly dropped a bit after the primary quarter announcement as a result of analysts had been anticipating a good greater quarter.)

Q2 2020 – Netflix Shrugs Off New Opponents

Prime Exhibits: House Drive. Too Sizzling to Deal with

Prime Movies: Extraction, The Incorrect Missy

The quarter began out rather well for Netflix as they dropped their third hottest present Cash Heist (La Casa de Papel), which continues to be a juggernaut of curiosity in all places (besides America). The run from Spenser Confidential to Ozark/Tiger King to Cash Heist to the Chris Hemsworth helmed Extraction is perhaps certainly one of Netflix’s finest of their historical past. After that, although, Netflix had certainly one of its weaker runs of content material with a few of their anticipated hits failing to ship outcomes, like House Drive, By no means Have I Ever and Ground Is Lava.

Not that it actually mattered. Everybody was nonetheless in lockdown in order that they saved watching lots of Netflix. Even with the weaker content material slate, Netflix nonetheless added a formidable 10 million world subscribers (5.5% development). That was two nice quarters of subscriber development in a row.

Furthermore, Netflix beat again the primary spherical of recent entrants to the streaming wars. Quibi got here and shortly discovered that even with billions in spending on new content material, they couldn’t compete. (They introduced they had been shutting down in October of 2020.) Then AT&T launched HBO Max, principally to shoulder shrugs from prospects. Since most subscribers who wished it already had HBO, the variety of people utilizing HBO Max solely acquired as much as 8 million by the end of the summer. NBC Common’s huge new streamer, Peacock, additionally didn’t make a dent since its greatest launch occasion, The Olympics, was postponed to 2021.

Netflix took benefit of this lack of competitors and broke a file of its personal: it lastly began earning profits. After anticipating to lose $1 billion {dollars} (give or take just a few hundred million), Netflix introduced that they anticipated to truly break even in 2020. By the top of the yr, we’d discover out that this two was too conservative and Netflix truly made $1.Eight billion in money, the primary time since 2011.

What drove this new discovered money movement? Just a few issues. First, Netflix had the 2 superb quarters of subscriber development. Second, advertising and marketing prices to accumulate these subscribers dropped as effectively, each as a result of prospects had been flocking to Netflix and since TV/digital promoting charges plummeted within the recession.

Greater than all that, although, was the pause in manufacturing for nearly half of the yr, whereas nonetheless having a backlog of exhibits to air. It seems that Netflix holds their movies and exhibits for even longer than I had estimated, in some circumstances as much as 9 months or extra. Which means, that Netflix may pause their productions for months and nonetheless launch new exhibits and flicks all through 2021. (In contrast to, say, Disney+ which solely had one present completed capturing earlier than the manufacturing hiatus, The Mandalorian.)

The outcome? Netflix inventory continued its upward trajectory, ending at $526 earlier than earnings, which dipped after the announcement to $494.

Q3 – Netflix Subscriber Development Stalls Below a Weak Content material Slate

Prime Exhibits: Cobra Kai, The Umbrella Academy S2, Lucifer.

Prime Movies: Previous Guard. Kissing Sales space 2, Enola Holmes

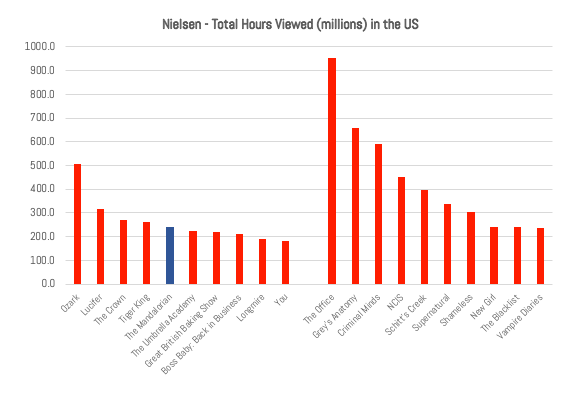

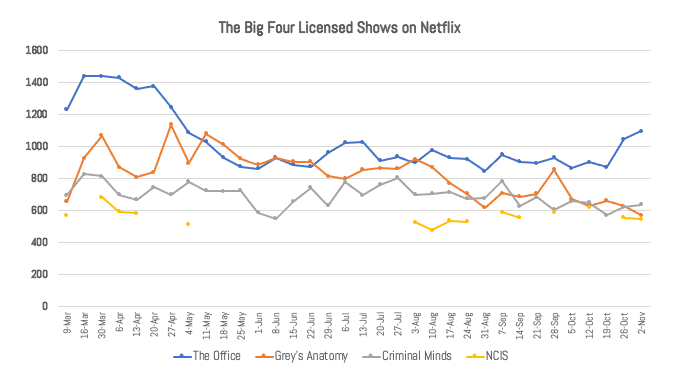

For Netflix observers like myself, August 2020 had a brand new milestone because it was the primary time we lastly had a 3rd occasion firm offering rankings information for Netflix. Particularly, Nielsen began releasing a weekly high ten of the most well-liked content material in streaming by complete minutes seen. This allowed me to trace, for instance, how popular the top four licensed series were on Netflix:

Sadly, Nielsen doesn’t present rankings exterior of the US. Nevertheless, it’s the very best non-Netflix steady look we’ve at Netflix’s viewership but.

The story of the third quarter was that Netflix lastly had a weak—for them—quarter for content material. They nonetheless had buzzy movies and exhibits that tens of tens of millions of parents watched, like The Previous Guard (78 million viewers watched 2 minutes within the first 28 days), Enola Holmes (76 million) or The Umbrella Academy season 2 (43 million subscribers).

However different opponents lastly began taking a chunk of subscribers, particularly in just a few given territories. Hamilton was a ratings smash in the United States. And The Boys was a global sensation. I referred to as every “The winner of the month” in my common column at Decider.

This led to the worst quarter of the yr for Netflix. After estimating low subscriber development, they “solely” grew by 2.2 million subscribers (1.1% quarterly development) and missed their development forecast. As they acknowledged, as a substitute of easy development, the Covid-19 lockdowns accelerated development in Q1 and Q2, that means people who would have subscribers later within the yr determined to take action when lockdowns occurred.

The opposite information was govt transition. In July, Netflix introduced that Ted Sarandos would be a part of Reed Hastings as “co-CEO”. On this new position, Sarandos modified up his growth groups, changing former TV head Cindy Holland with Bela Bajaria as the new head of television. This information was a pinch stunning provided that Netflix has claimed a number of success in TV, but nonetheless felt a necessity to alter management groups. Netflix calls this the “keeper check”, and for those who don’t go Hastings has usually let even very senior folks go.

The outcomes? Netflix had its greatest slip of the yr, going into earnings at $528 per share and per week later dipping to $486. Till the top of the yr, Netflix would hover round $500 per share.

This fall – Netflix Finishes 2020 Sturdy

Prime Exhibits: Bridgerton, The Queen’s Gambit, The Crown season 4

Prime Movies: The Midnight Sky, Christmas Chronicles 2.

They usually had been again! Netflix completed off 2020 on a streak of content material nearly nearly as good as their March to April run. Beginning with The Queen’s Gambit, Netflix had buzzy exhibits producing a number of views. As well as, Netflix aired their ordinary slate of “status” movies competing for finish of yr awards, just like the Oscars. In contrast to different years, Netflix is among the solely studios truly releasing movies!

The streaming wars additionally heated up in December as opponents threw their finest pictures but at Netflix. Netflix launched Shonda Rhimes first present Bridgerton below her total deal on Christmas Day, and it went up in opposition to Soul at Disney+ and Surprise Girl 1984 on HBO Max. That was a titanic battle that the theatrical films likely won, however simply barely.

That mentioned, Netflix returned to development, including 8.5 million world prospects (4.4% development) and once more besting their forecast. And Netflix improved its financials throughout the board, rising income from $20.1 to $24.99 billion (21.5%), revenue rising from $1.Eight to $2.7 billion (48%) and world subscribers from 167 to 203.7 million (22%). Furthermore, Netflix had managed to get to full-production by This fall.

And as I mentioned above, Netflix skilled a free money movement constructive yr for the primary time since 2011. Crucially for buyers, Netflix introduced that in 2021, it anticipated to interrupt even and stay money movement constructive going ahead. Frankly, that is the very best information for Netflix of all the large headlines. With this announcement, Netflix will now not must tackle debt. Now, the following step is as necessary for Netflix—making huge free cash flow like their tech peers—however this was step one.

The Consequence? Netflix achieved its highest inventory worth but, of $582 {dollars} for a market capitalization of practically $250 billion.

(The Leisure Technique Man writes under this pseudonym at his eponymous website. A former exec at a streaming firm, he prefers writing to sending emails/attending conferences, so he launched his personal web site. Sign up for his newsletter at Substack for normal ideas and evaluation on the enterprise, technique and economics of the media and leisure business.)