Image – Getty Photographs

With acquisition and merger mania happening in media proper now, we welcome again The Leisure Technique Man for a two-part collection trying into if Netflix ought to soar into the motion. This primary entry will check out Netflix’s earlier efforts in mergers and acquisitions and look into why they need to make an acquisition. Half two, due out tomorrow, will dive into 9 appropriate merger or acquisition targets.

Merger and acquisitions (M&A) hypothesis is the social media of enterprise commentary; it isn’t very productive, nevertheless it’s nonetheless plenty of enjoyable.

Take the endless distraction of social media. Like Twitter. I ought to be writing an article—like this one—however as a substitute, I’m debating strangers on the deserves of the newest Netflix improvement deal and what it “means”. In different phrases, not very productive, however addictive as hell.

Speculating about M&A is commonly the identical means. A very nice technique is tough. It requires a visionary CEO to look at the aggressive panorama, determine tendencies, and supply prospects a wonderful product that solely their firm can supply. That’s powerful! Have you learnt what’s even more durable? Attempting to divine whether or not an organization’s technique is working. That requires plenty of work and analysis and modeling. Robust!

You already know what is straightforward? Guessing who can purchase who. Or “M&A hypothesis”.

For all of the failures of previous M&A offers, the media—and Twitter!—love to take a position about mergers and acquisitions. Ought to Amazon purchase CBS? Ought to Apple purchase Disney? Or ought to Netflix purchase, properly, everybody?

And more often than not, all this hypothesis is for naught. Was anybody saying Disney would purchase Fox? Not that I learn. Was anybody saying that AT&T would promote Warner Media to Discovery? Once more, not that I noticed!

(Additionally in full disclosure, this text was written earlier than the Discovery-AT&T information of the final week, however has been up to date since.)

What’s Really Nice M&A?

Let’s begin with a definition of nice technique, which is itself a tricky process. A terrific technique means having a aggressive benefit that’s sustained by an organization’s sources of energy. This finally ends in delivering actually nice services or products to prospects.

In order for you an instance, assume no additional than Netflix this previous decade. They’ve been relentlessly targeted on providing an unbelievable streaming expertise they usually’ve been rewarded with an enormous and devoted buyer base. They usually’ve largely performed this with out shopping for different firms.

What separates good mergers and acquisitions from unhealthy ones? Nicely, if an organization has technique, then mergers and acquisitions ought to reinforce that (hopefully good) technique. The exemplar in leisure this final decade-plus was Disney. Earlier than 2008, Disney was already the best-known model in leisure. However they had been primarily recognized for Disneyland, Mickey Mouse, Princesses, and some different issues. To bolster these manufacturers, they purchased the most effective animation studio out there in Pixar, a powerhouse of superhero IP in Marvel, and probably the most effective franchise in the marketplace in Star Wars. In essence, 4 of the “5 pillars” of the Disney+ UX had been all bought within the final decade. These had been sensible acquisitions.

SHANGHAI, CHINA – APRIL 08: Vacationers watch a nighttime firework and lightweight present on the Disney fortress as Shanghai Disney Resort celebrates fifth birthday, on April 8, 2021 in Shanghai, China. (Photograph by VCG/VCG by way of Getty Photographs)

Unhealthy M&A tends to be like unhealthy technique: it doesn’t have some extent. In different phrases, some companies merely purchase different firms merely to get larger to seek out “synergies” that don’t actually exist. Within the final decade, I’d level to Comcast shopping for NBC-Common as a deal that didn’t actually reinforce any of Comcast’s technique, besides to bulk up for bulking up’s sake.

Nonetheless, deal-making has two components: the worth of the deal (reinforcing technique) and the associated fee (the value you pay). A great buy in M&A that isn’t on the proper worth can nonetheless be unhealthy strategically. Devastating even. One of the best instance within the final decade is AT&T, who possible overpaid for each DirecTV (which they wrote down and offered) and Time-Warner (who they simply offered as properly, for half the value.)

Historical past: What Has Been Netflix’s Method to M&A?

In two phrases:

Not a lot.

The rationale why Netflix is such instance of nice, strike that, wonderful technique, is that they did it with out losing plenty of effort on merging or buying opponents. Numerous different opponents in streaming cobbled collectively area of interest streamers or purchased different leisure firms. Netflix stated, “Why purchase that once we can construct it?”

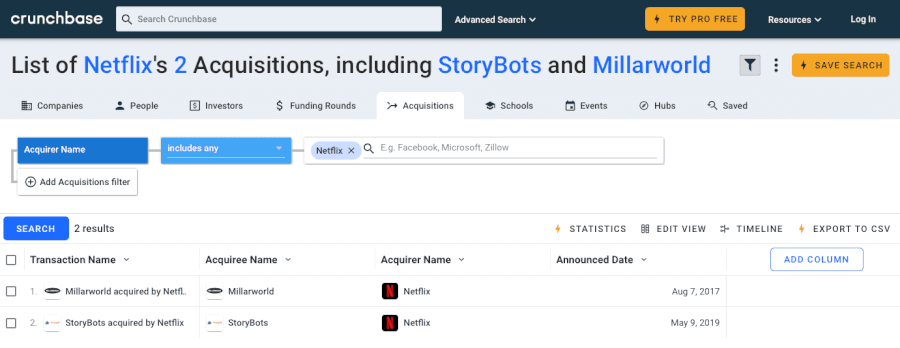

Significantly, right here is their Crunchbase biography:

In the meantime, different tech giants like Google or Amazon or Fb have been on shopping for binges the final decade. Google bought a company per week in 2010 and 2011. Fb has bought over 89 companies.

Netflix has purchased solely three firms. (And if I missed any others, they had been possible so small as to not matter.) The highlights being…

- Millarworld – For an undisclosed worth (rumored between $30-100 million), Netflix bought the comic book company owned by creator Mark Millar. Millar is the creator behind movies resembling Kick Ass and Wished. This week, his first mission for Netflix will come to the streamer—Jupiter’s Legacy—although his (arguably) most anticipated title—The Magic Order—has been in limbo.

- Storybots by way of Jibjab. Netflix needs to aggressively compete for youths programming, particularly animated content material. In 20XX, Netflix bought the Storybots brand from Jibjab, a maker of children animated programming.

- Manufacturing services in New Mexico. Netflix additionally spent $30 million to buy production facilities in New Mexico in 2018. Just lately, they introduced plans to spend $1 billion on increasing their services.

Whereas these offers are small, they nonetheless reinforce Netflix’s technique. For probably the most half, Netflix needs to develop their very own IP, however clearly they felt the necessity to purchase each comedian guide IP and youngsters IP to hurry up the method. Netflix can be a manufacturing juggernaut, so it was cheaper to purchase a manufacturing studio in New Mexico than persevering with to hire area.

General, although, you may’t take a lot from Netflix’s historical past as a result of clearly their purpose is to not buy different firms, however to construct organically.

How A lot Can Netflix “Spend” on M&A?

The limiting issue on M&A is usually how a lot an organization’s steadiness sheet can assist shopping for different firms. Acquisitions aren’t free. With out diving too deep into the monetary mechanics, an organization can do that by providing both money or inventory worth. The previous is straightforward: you pay them the cash. For the latter, this often means providing a set variety of shares for a given quantity of the goal firm’s shares. If an organization doesn’t have the money available, they usually often don’t, they’ll additionally tackle debt to purchase different firms. (Once more, have a look at AT&T this decade.)

Crucially, the quantity an organization pays is often at a premium (which means larger) than the present market worth of an organization. For privately traded firms, that is some a number of over the past funding spherical. For public firms, that is some share above the “market capitalization” of a agency on the worth earlier than the deal is introduced.

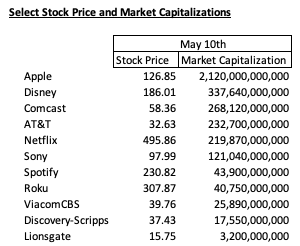

What’s market capitalization? Nicely, that’s the value per share multiplied by the variety of shares an organization has issued (excellent in trade parlance). To supply just a few examples—which had been present as of Could 10th once I wrote this—right here is Netflix and another main streamers/leisure firms:

For our functions, I’m going to spherical a few of these numbers. So for Netflix, you may say they’re roughly an $225 billion sized agency. Given how their inventory can transfer round, at any given second, they’re a $200-$250 billion firm.

One final word. Whereas it could possibly seem to be providing inventory is a “free” technique to purchase prospects, it most undoubtedly shouldn’t be. When a agency difficulty new shares, they’re diluting current prospects. A inventory is a declare on some portion of an organization’s future earnings. When you solely had one share, a sole proprietor, they get all the long run earnings. But when that hypothetical agency offered 9 new shares, the primary individual solely has declare to 10% of future earnings. They’ve been diluted by 90%. If Netflix “purchased” a agency by issuing new shares that price $50 billion, they’d dilute their present homeowners by 18%. (Roughly.)

The Antitrust Panorama

So I’ve stated M&A could be both 1. Reinforcing good technique or 2. Shopping for companies for getting’s sake. The previous is nice, the latter is unhealthy technique. We may add a 3rd pillar:

- Shopping for competing companies to nook a market and reduce competitors.

Arguably, that is probably a “good” technique, nevertheless it comes with such excessive prices for society that it’s price calling out individually. Like different issues which can be unhealthy for society, it’s unlawful. And never simply getting sued “civil” unlawful, it is criminal. An organization’s management may go to jail for breaking “antitrust” legal guidelines. (Although they rarely do anymore.)

Non-public fairness companies, particularly, use M&A to roll up smaller industries in a transfer known as “a roll up”. (Significantly try salt consolidation within the American Midwest or consolidation in cheerleading.) It’s additionally the rationale driving Fb and Google. Fb purchased WhatsApp and Instagram expressly in order that they couldn’t compete in social. Google bought ad-word markets to extend its management of digital promoting. The federal government additionally alleges that Google and Fb cooperated to regulate markets.

In all these instances, the purpose isn’t actually synergy, however measurement. With measurement comes better-negotiating energy with suppliers and prospects. I doubt Netflix may change into this large in both manufacturing or distribution to warrant scrutiny from US or international antitrust regulators. That stated, it more and more appears just like the EU, US and even Chinese language regulators are cracking down on Large Tech mergers. Netflix is part of Large Tech—they had been within the FAANG acronym in spite of everything—so if Netflix went on a shopping for spree, they might come underneath the identical monitoring as Google, Amazon, Apple and Fb.

What Does Netflix Want within the 2020s?

How can M&A assist Netflix reinforce its aggressive benefit? Listed here are just a few broad areas:

– Content material. Netflix’s content material spend proper now could be partially so excessive as a result of they should construct a library from scratch. If they might purchase a competitor or producer for lower than the price of constructing that library from scratch, that would assist tremendously.

– Distribution. The subsequent part of the streaming wars might transfer from streamers to the distributors of streamers. Roku, Amazon, Apple, and even Comcast are vying to be the conduit for the way you watch content material. It could assist Netflix to have a foothold in that world.

– Diversification. Proper now, Netflix is the king of streaming video. However solely “on-demand” video. They don’t have stay TV, information, sports activities or a free mannequin. Doubtlessly, they might diversify their income streams to incorporate stay TV, promoting, or different enterprise fashions.

To summarize: Netflix has traditionally ignored M&A, however in just a few areas there are distinct alternatives if the value is correct. Subsequent time, we’ll speculate on these.

(The Leisure Technique Man writes underneath this pseudonym at his eponymous web site. A former exec at a streaming firm, he prefers writing to sending emails/attending conferences, so he launched his personal web site. Sign up for his newsletter at Substack for normal ideas and evaluation on the enterprise, technique and economics of the media and leisure trade.)